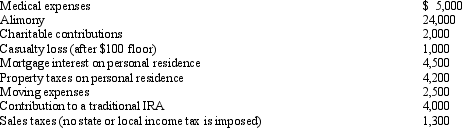

Austin, a single individual with a salary of $100,000, incurred and paid the following expenses during the year:

Calculate Austin's deductions for AGI.

Calculate Austin's deductions for AGI.

Definitions:

Institutional Expectations

The norms, values, and standards expected by societal institutions or groups, which influence behavior and practices within organizations.

External Adaptation

External adaptation involves the ways in which an organization or organism adjusts to changes in its external environment to survive and thrive.

Systematic Integration

The strategic and organized combination of different elements, systems, or processes to work as a unified whole.

Observable Attitudes

Attitudes that can be visibly inferred or interpreted through an individual's actions, expressions, or behaviors.

Q4: Last year, Sarah (who files as single)

Q22: James purchased a new business asset (three-year

Q35: Augie purchased one new asset during the

Q53: A taxpayer takes six clients to an

Q63: There is no cutback adjustment for meals

Q73: The taxpayer incorrectly took a $5,000 deduction

Q98: An accrual basis taxpayer who owns and

Q112: All listed property is subject to the

Q117: Which of the following is incorrect?<br>A) All

Q130: For the past few years, Corey's filing