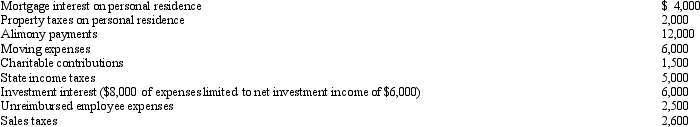

Arnold and Beth file a joint return.Use the following data to calculate their deduction for AGI.

Definitions:

Life Expectancy

The average number of years an individual is expected to live, based on current mortality rates.

Production Costs

The total expenses incurred in the manufacturing of a product, including labor, materials, and overhead costs.

Short-run Economic Profits

Profits earned by a firm in the short run, where not all inputs can be varied and some fixed costs are still incurred.

Competitive Industries

Sectors of the economy where businesses actively compete with each other to offer goods or services to consumers, often characterized by low barriers to entry and a high level of innovation.

Q2: The cost of repairs to damaged property

Q40: In May 2012, after 11 months on

Q75: Red Company is a proprietorship owned by

Q101: Felicia, a recent college graduate, is employed

Q105: The realization requirement gives an incentive to

Q109: Under the terms of a divorce agreement,

Q114: Ordinary and necessary business expenses, other than

Q119: Bobby operates a drug trafficking business.Because he

Q120: When married persons file a joint return,

Q148: If a taxpayer operated an illegal business