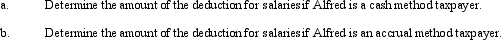

Alfred's Enterprises, an unincorporated entity, pays employee salaries of $92,000 during the year. At the end of the year, $9,000 of additional salaries have been earned but not paid until the beginning of the next year.

Definitions:

Amyloplasts

A type of plastid found in some plant cells, responsible for the synthesis and storage of starch granules through the process of photosynthesis.

Root Cap

A protective structure located at the tip of a plant root that shields the growing tip in the soil, secretes mucilage to aid in movement, and perceives gravity.

Phototropin

A protein that acts as a blue-light receptor, causing phototropic responses in plants towards light sources.

Phototropic Response

the growth or movement of a plant organ toward or away from light, as a response to its direction.

Q7: What losses are deductible by an individual

Q26: Motel buildings are classified as residential rental

Q34: In 2012, Wally had the following insured

Q40: On July 15, 2012, Mavis paid $275,000

Q52: Martha rents part of her personal residence

Q61: In choosing between the actual expense method

Q65: A realized loss is recognized by a

Q74: For 2012, Stuart has a short-term capital

Q79: On March 3, 2012, Sally purchased and

Q90: All employment related expenses are classified as