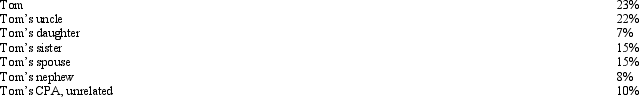

The stock of Eagle, Inc.is owned as follows:

Tom sells land and a building to Eagle, Inc.for $212,000.His adjusted basis for these assets is $225,000.Calculate Tom's realized and recognized loss associated with the sale.

Tom sells land and a building to Eagle, Inc.for $212,000.His adjusted basis for these assets is $225,000.Calculate Tom's realized and recognized loss associated with the sale.

Definitions:

Per-hour Wage

The amount of money paid to an employee for each hour of work.

Payroll Tax

Financial obligations placed on employers and workers, regularly computed based on a percentage of the compensation paid to workers.

Per-hour Wage

Compensation paid to an employee based on the number of hours worked.

Payroll Tax

Dues extracted from employers or laborers, usually as a percentage of the salary expenditures.

Q3: The only asset Bill purchased during 2012

Q19: Wayne owns a 25% interest in the

Q31: Maroon Corporation expects the employees' income tax

Q36: The amount of partial worthlessness on a

Q37: Even if the individual does not spend

Q67: On January 1, 2012, an accrual basis

Q67: Beverly died during the current year.At the

Q77: Qualifying job search expenses are deductible even

Q103: Legal fees incurred in connection with a

Q113: Ron, age 19, is a full-time graduate