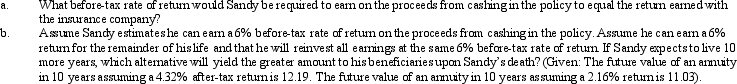

Sandy is married, files a joint return, and expects to be in the 28% marginal tax bracket for the foreseeable future.All of his income is from salary and all of it is used to maintain the household.He has a paid-up life insurance policy with a cash surrender value of $100,000.He paid $60,000 of premiums on the policy.His gain from cashing in the life insurance policy would be ordinary income.If he retains the policy, the insurance company will pay him $3,000 (3%) interest each year.Sandy thinks he can earn a higher return if he cashes in the policy and invests the proceeds.

Definitions:

Inflections

Variations in the form of words to express different grammatical categories such as tense, mood, voice, aspect, person, number, gender, and case.

Biological Correlates

Biological factors or processes that are associated with specific psychological or behavioral phenomena.

Character Flaws

Inherent weaknesses or imperfections in a person's character that may lead to negative outcomes or hinder personal development.

Deep-Seated

Firmly fixed or rooted; ingrained in the deepest part of a person's mind or nature.

Q22: The IRS encourages _ filing for Forms

Q36: The amount of partial worthlessness on a

Q40: Tommy, an automobile mechanic employed by an

Q47: Which of the following is not a

Q58: Under what circumstances, if any, may an

Q61: During the year, Irv had the following

Q64: Pedro is married to Consuela, who lives

Q97: If personal casualty losses (after deducting the

Q150: When filing their Federal income tax returns,

Q165: Faith just graduated from college and she