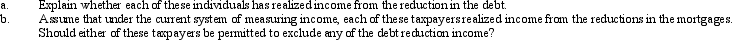

Sally and Ed each own property with a fair market value less than the amount of the outstanding mortgage on the property and also less than the original cost basis.They each were able to convince the mortgage holder to reduce the principal amount on the mortgage.Sally's mortgage is on her personal residence and Ed's mortgage is on rental property he owns.

Definitions:

Factoring Transaction

The process where a business sells its accounts receivable (invoices) to a third party (factor) at a discount, in exchange for immediate cash.

GAAP

Generally Accepted Accounting Principles, a set of rules and standards designed to ensure consistency, fairness, and accuracy in financial reporting and accounting practices in the U.S.

IFRS

International Financial Reporting Standards, a set of accounting standards developed by the International Accounting Standards Board (IASB) that is global in scope.

Factoring Transaction

A financial transaction where a business sells its accounts receivable to a third party at a discount to obtain immediate cash.

Q20: What Federal income tax benefits are provided

Q27: Tommy, a senior at State College, receives

Q37: Margaret is trying to decide whether to

Q61: Mitch is in the 28% tax bracket.

Q74: On January 1, 2012, Faye gave Todd,

Q84: The filing status of a taxpayer (e.g.,

Q99: Ridge is the manager of a motel.As

Q104: Evan and Eileen Carter are husband and

Q105: Which, if any, of the following is

Q134: Which of the following taxpayers use a