Multiple Choice

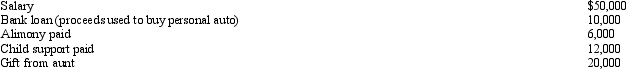

During 2012, Marvin had the following transactions:  Marvin's AGI is:

Marvin's AGI is:

Definitions:

Related Questions

Q4: For purposes of the § 267 loss

Q16: The Julius Trust made a gift to

Q27: Janice is single, had gross income of

Q39: The Doyle Trust reports distributable net income

Q41: Leo underpaid his taxes by $250,000.Portions of

Q46: Which of the following is not a

Q46: For a person who is in the

Q90: The tax preparer penalty for taking an

Q91: Ming (a calendar year taxpayer) donates a

Q124: Generally, capital gains are allocated to fiduciary