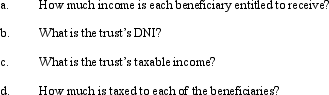

Counsell is a simple trust that correctly uses the calendar year for tax purposes.Its income beneficiaries (Kathie, Lynn, Mark, and Norelle) are entitled to the trust's annual accounting income in shares of one-fourth each.For the current calendar year, the trust has ordinary business income of $40,000, a long-term capital gain of $20,000 (allocable to income), and a trustee commission expense of $4,000 (allocable to corpus).Use the format of Figure 28.3 in the text to address the following items.

Definitions:

Lemonade Stand

A small, temporary drink stand often run by children, where lemonade is sold, typically as an introduction to business principles.

Transfer Price

The price at which goods, services, or intellectual properties are traded between different divisions within the same company.

Transfer Price

The price at which divisions of a company transact with each other, such as the trade of supplies or labor between departments.

Market Price

The current price at which an asset or service can be bought or sold in a marketplace.

Q25: Beneficiary information concerning a trust's income and

Q37: Margaret is trying to decide whether to

Q64: The Perfection Tax Service gives employees $12.50

Q73: Susan purchased an annuity for $200,000.She is

Q75: Trusts can select any fiscal Federal income

Q97: If an exempt organization conducts a trade

Q107: The Martins have a teenage son who

Q124: Federal taxable income is used as the

Q126: The Purple Trust incurred the following items

Q136: A fiduciary's cost recovery deductions are assigned