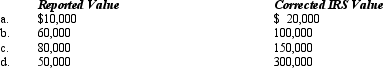

Compute the undervaluation penalty for each of the following independent cases involving the executor's reporting of the value of a closely held business in the decedent's gross estate.In each case, assume a marginal estate tax rate of 45%.

Definitions:

Average Total Cost

The cost per unit of output, calculated by dividing the total production cost by the quantity of output produced.

Marginal Revenue

The supplementary earnings acquired from selling an extra unit of a product or service.

Competitive Market

A market structure where multiple firms are vying for consumers' business, thereby fostering innovation and fair pricing due to competition.

Total Revenue

The full amount of capital a business garners from the sale of goods or the rendering of services for a particular timeframe.

Q36: Which of the following statements best describes

Q80: Which of the following statements regarding foreign

Q83: Scott, Inc., a domestic corporation, receives a

Q101: State Q has adopted sales-factor-only apportionment for

Q119: The amount of Social Security benefits received

Q120: A controlled foreign corporation (CFC) realizes Subpart

Q123: Jerry purchased a U.S.Series EE savings bond

Q135: Nice, Inc., a § 501(c)(3) organization, inherited

Q135: Which of the following is not a

Q141: Given the following information, determine if FanCo,