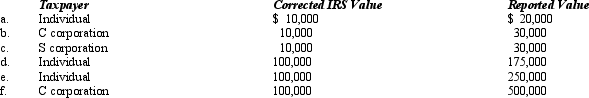

Compute the overvaluation penalty for each of the following independent cases involving the taxpayer's reporting of the fair market value of charitable contribution property.In each case, assume a marginal income tax rate of 35%.

Definitions:

Windigo Psychosis

A culture-specific disorder found among indigenous peoples of North America characterized by intense cravings for human flesh and fear of becoming a cannibal.

Self-awareness

An understanding of one's personal identity, emotional states, motivations, and aspirations.

Western Biomedicine

A system of medical practice that applies biological and physiological principles to clinical care, often contrasted with traditional or alternative medicines.

Scientific Methods

Systematic procedures and techniques used for conducting research, including observation, experimentation, and hypothesis testing.

Q3: The Suarez Trust generated distributable net income

Q43: Generally, an administrative expense should be claimed

Q65: The annual increase in the cash surrender

Q78: The Circle Trust has some exempt interest

Q90: A per-day, per-share allocation of flow-through S

Q100: The depreciation deductions of a trust usually

Q119: Unrelated debt-financed income, net of the unrelated

Q132: Married taxpayers who file a joint return

Q135: The Section 179 expense deduction is a

Q143: The general statute of limitations regarding Federal