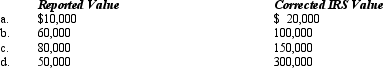

Compute the undervaluation penalty for each of the following independent cases involving the executor's reporting of the value of a closely held business in the decedent's gross estate.In each case, assume a marginal estate tax rate of 45%.

Definitions:

Rehearsal

The cognitive process of repeatedly practicing or going over information to aid in its retention and recall.

Elaboration

The process of adding more information to or providing additional details on a subject.

Bodily-kinesthetic

Intelligence that pertains to the ability to control physical motion and handle objects skillfully, as posited by Howard Gardner's theory of multiple intelligences.

Interpersonal

Concerning or involving relationships between people, especially regarding communication and emotional interaction.

Q7: The use tax is designed to complement

Q22: SunCo, a domestic corporation, owns a number

Q24: What income and activities are not subject

Q27: A typical state taxable income addition modification

Q62: In most states, a limited liability company

Q81: Maude's parents live in another state and

Q98: If an exempt organization is required to

Q101: In determining the filing requirement based on

Q118: For the year a spouse dies, the

Q145: Kyle and Liza are married and under