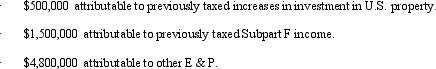

Xenia, Inc., a U.S.shareholder, owns 100% of Fredonia, a CFC.Xenia receives a $3 million cash distribution from Fredonia.Fredonia's E & P is composed of the following amounts.  Xenia recognizes a taxable dividend of:

Xenia recognizes a taxable dividend of:

Definitions:

Trainee-Initiated

Trainee-initiated refers to activities or learning processes that are started and directed by the learners themselves, fostering autonomy and self-directed learning.

Collaborative

Involving two or more parties working together towards a common goal.

Multilevel Systems Model

A framework that analyzes interactions across different layers or levels within an organization or system, considering factors from individual to societal influence.

Organizational Learning

The ability of an organization to gain insight and understanding from experience and apply it to improve its practices, strategies, and policies.

Q24: Last year, Ned's property tax deduction on

Q28: Harry, the sole income beneficiary, received a

Q44: A private foundation is subject to which

Q48: In resolving qualified child status for dependency

Q69: A tax preparer is in violation of

Q73: Hendricks Corporation, a domestic corporation, owns 40

Q80: A state or local tax on a

Q84: The Form 1041 of a calendar-year trust

Q105: You are responsible for the Federal income

Q141: Exempt organizations which are appropriately classified as