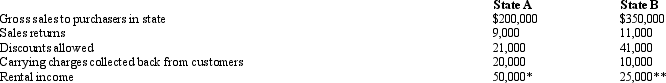

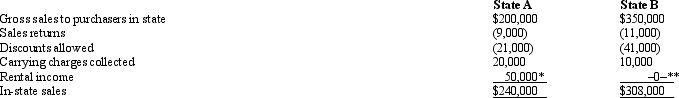

Shaker Corporation operates in two states, as indicated below.All goods are manufactured in State

A.Determine the sales to be assigned to both states to be used in computing Shaker's sales factor for the year.Both states follow the UDITPA and the MTC regulations in this regard.

* Excess warehouse space

* Excess warehouse space

** Land held for speculation

* Excess warehouse space, related to business

* Excess warehouse space, related to business

** Land held for speculation, nonbusiness income

Definitions:

Work in Process Inventory

Inventory that includes materials that have been partially worked on but are not yet completed products.

Factory Overhead

All indirect costs associated with the production process, such as utilities, maintenance, and salaries of non-direct labor.

Work in Process Inventory

Goods that are partially completed in the manufacturing process but are not yet ready for sale.

Factory Wages Payable

The amount owed to factory workers for labor that has not yet been paid.

Q10: Waldo, Inc., a U.S.corporation, owns 100% of

Q38: Freddie has been assessed a preparer penalty

Q41: Leo underpaid his taxes by $250,000.Portions of

Q82: Paul sells one parcel of land (basis

Q85: Match each of the following statements with

Q87: "Inbound" and "offshore" asset transfers by a

Q95: A trade or business that is operated

Q112: In connection with the taxpayer penalty for

Q140: An S corporation may be subject to

Q141: Given the following information, determine if FanCo,