Mercy Corporation, headquartered in F, sells wireless computer devices, including keyboards and bar code readers. Mercy's degree of operations is sufficient to establish nexus only in E and

F.Determine its sales factor in those states.

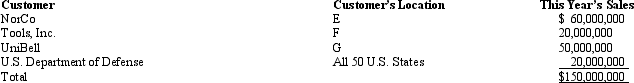

State E applies a throwback rule to sales, while State F does not.State G has not adopted an income tax to date.Mercy reported the following sales for the year.All of the goods were shipped from Mercy's F manufacturing facilities.

Because F has not adopted a throwback rule, the sales to customers in G and to the U.S.government are not included in either state's sales factor.Mercy creates $70 million in "nowhere sales."

E Sales factor = $60 million/$150 million = 40.00%

F Sales factor = $20 million/$150 million = 13.33%

Definitions:

Labor Cost Variance

The difference between the actual labor costs incurred and the standard labor costs for the actual production achieved; it is used for monitoring labor performance.

Standard Cost

A predetermined cost of manufacturing, purchasing, or using a product or service, used in budgeting and variance analysis.

Q33: Evaluate this statement: the audited taxpayer has

Q41: A partnership has accounts receivable with a

Q68: A gift to charity from its 2012

Q72: Michelle, a calendar year taxpayer subject to

Q72: A number of court cases in the

Q76: In the broadest application of the unitary

Q78: For a new corporation, a premature S

Q83: Justin and Kevin formed the equal JK

Q93: Brooke and John formed a partnership.Brooke received

Q139: For purposes of the unrelated business income