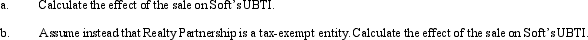

Soft, Inc., a § 501(c)(3) organization, has been leasing a building to Ice, Inc., a taxable entity, for 12 years.The lease terminates in the current tax year.Soft's adjusted basis for the building is $350,000.It sells the building to the Realty Partnership, a taxable entity, for $625,000.Selling expenses are $37,500.

Definitions:

Epileptic Seizure

A sudden surge of electrical activity in the brain that affects how a person appears or acts for a short time.

Social Psychologist

A psychologist specializing in understanding how individual thoughts, feelings, and behaviors are influenced by the actual, imagined, or implied presence of others.

Quasi-Experiment

An empirical study used to estimate the causal impact of an intervention without random assignment of participants to conditions or orders of conditions.

Self-Image

An individual's conception of themselves, often encompassing physical appearance, abilities, and personality traits.

Q11: If the unrelated business income of an

Q17: Which of the following statements is/are correct

Q20: Which of the following statements are correct?<br>A)If

Q25: The MOG Partnership reports ordinary income of

Q52: Post-1984 letter rulings may be substantial authority

Q85: Match each of the following statements with

Q91: A church is one of the types

Q116: The LMO Partnership distributed $30,000 cash to

Q133: The excise tax imposed on private foundations

Q152: An S shareholder's stock basis is reduced