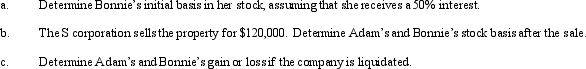

Individuals Adam and Bonnie form an S corporation, with Adam contributing cash of $100,000 for a 50% interest and Bonnie contributing appreciated ordinary income property with an adjusted basis of $20,000 and a fair market value of $100,000.

Definitions:

Retail Location

A physical space where consumer goods are sold directly to customers, crucial for a business's accessibility and sales performance.

Extreme-Value Retailers

Stores that specialize in offering a wide range of products at exceptionally low prices, often in a no-frills shopping environment.

Corner Store

A small retail outlet, often located on a street corner, offering a limited range of household goods and groceries.

Supercenter

A large retail establishment that combines a supermarket and a department store, offering a wide range of products under one roof.

Q2: Which of the following statements is always

Q4: Corporate shareholders generally receive less favorable tax

Q16: Which of the following statements regarding the

Q38: Realized gain is recognized by an S

Q42: A state sales tax usually falls upon:<br>A)Sales

Q48: Node Corporation is subject to tax only

Q54: In determining whether § 357(c) applies, assess

Q74: On January 1, Tulip Corporation (a calendar

Q83: Justin and Kevin formed the equal JK

Q122: Which of the following exempt organizations are