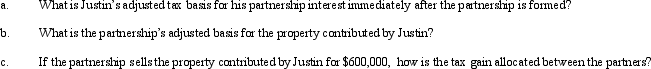

Greg and Justin are forming the GJ Partnership.Greg contributes $500,000 cash and Justin contributes nondepreciable property with an adjusted basis of $200,000 and a fair market value of $550,000.The property is subject to a $50,000 liability, which is also transferred into the partnership and is shared equally by the partners for basis purposes.Greg and Justin share in all partnership profits equally except for any precontribution gain, which must be allocated according to the statutory rules for built-in gain allocations.

Definitions:

Stockholders' Equity

The ownership interest of stockholders in the assets of a corporation, calculated as total assets minus total liabilities.

Accruals

Accounting adjustments for revenues that have been earned but are not yet recorded in the accounts, and for expenses that have been incurred but are not yet recorded.

Incurred

This term refers to the recognition of costs or expenses in accounting when a company commits to them through its operations, regardless of when payment is made.

Wages Payable

Represents the total amount of wages earned by employees that have not yet been paid by the employer.

Q10: Under Public Law 86-272, a state is

Q17: Beth sells her 25% partnership interest to

Q35: Lucinda is a 60% shareholder in Rhea

Q35: Subchapter P refers to the "Partners and

Q49: Even though a church is not required

Q49: Korat Corporation and Snow Corporation enter into

Q72: Under the "check-the-box" Regulations, a two-owner LLC

Q90: Francisco is the sole owner of Rose

Q104: A _ tax is designed to complement

Q144: In a proportionate liquidating distribution in which