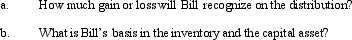

In a proportionate liquidating distribution in which the partnership is liquidated, Bill received cash of $120,000, inventory (basis of $6,000, fair market value of $8,000), and a capital asset (basis and fair market value of $16,000).Immediately before the distribution, Bill's basis in the partnership interest was $90,000.

Definitions:

Employee Retirement Income Security Act

A national regulation establishing basic requirements for the majority of privately initiated pension and health schemes in the private sector, aimed at safeguarding participants in these programs.

Drug-Free Workplace Act

A U.S. federal law that requires some employers to maintain a work environment free from the illegal use of drugs.

Fair Labor Standards Act

U.S. legislation that establishes minimum wage, overtime pay, recordkeeping, and child labor standards.

Vocational Rehabilitation Act

Federal legislation aimed at assisting individuals with disabilities in preparing for and engaging in gainful employment.

Q8: Since loss property receives a _ in

Q15: For corporate restructurings, meeting the § 368

Q17: The stock of Penguin Corporation is held

Q28: A feeder organization is exempt from Federal

Q32: An S corporation can take advantage of

Q34: There are 11 geographic U.S.Circuit Court of

Q51: Sparrow Corporation purchased 90% of the stock

Q54: What are the excise taxes imposed on

Q71: Which of the following is a correct

Q131: _ common stock and _ preferred stock