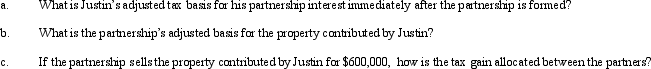

Greg and Justin are forming the GJ Partnership.Greg contributes $500,000 cash and Justin contributes nondepreciable property with an adjusted basis of $200,000 and a fair market value of $550,000.The property is subject to a $50,000 liability, which is also transferred into the partnership and is shared equally by the partners for basis purposes.Greg and Justin share in all partnership profits equally except for any precontribution gain, which must be allocated according to the statutory rules for built-in gain allocations.

Definitions:

Decertification Election

A process through which employees can vote to remove the representation of a labor union in their workplace.

Union Dues

Fees paid by members to labor unions to support their activities, including collective bargaining, legal representation, and other member services.

Secret Ballot Elections

A method of voting that ensures privacy for voters, allowing individuals to make choices without disclosing them publicly, commonly used in elections and union representation votes.

Voluntary Agreements

Contracts or settlements reached by mutual consent between parties, often used in labor relations to resolve disputes or establish working conditions.

Q3: Which of the following is not an

Q17: An S shareholder's basis is increased by

Q30: An S corporation can be a shareholder

Q38: The stock in Toucan Corporation is held

Q58: On December 31, 2012, Peregrine Corporation, an

Q77: Section 351 (which permits transfers to controlled

Q83: Which of the following statements are correct

Q106: Which of the following statements is correct

Q112: Consent to an S election must be

Q132: The JIH Partnership distributed the following assets