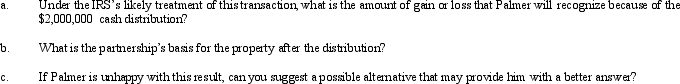

Palmer contributes property with a fair market value of $4,000,000 and an adjusted basis of $3,000,000 to AP Partnership.Palmer shares in $1,000,000 of partnership debt under the liability sharing rules, giving him an initial adjusted basis for his partnership interest of $4,000,000.One month after the contribution, Palmer receives a cash distribution from the partnership of $2,000,000.Palmer would not have contributed the property if the partnership had not contractually obligated itself to make the distribution.Assume Palmer's share of partnership liabilities will not change as a result of this distribution.

Definitions:

SADC

Southern African Development Community, a regional organization aimed at economic integration and development in Southern Africa.

Southeast Asia

A geographic region located to the south of China and to the east of India, known for its diverse cultures, languages, and economies.

Sustainable Development

Development that meets the needs of the present without compromising the ability of future generations to meet their own needs, emphasizing environmental conservation, social equity, and economic growth.

Global Corporations

Global corporations are large companies that operate and provide products or services in multiple countries around the world, often having a significant influence on the global economy.

Q18: The excise tax imposed on a private

Q21: During the current year, Owl Corporation (a

Q42: What statement is not true with respect

Q46: An expense that is deducted in computing

Q66: Randi owns a 40% interest in the

Q74: In calculating unrelated business taxable income, the

Q88: One month after Sally incorporates her sole

Q94: The taxable income of a partnership flows

Q115: While certain § 501(c)(3) organizations can elect

Q144: Outline the requirements that an entity must