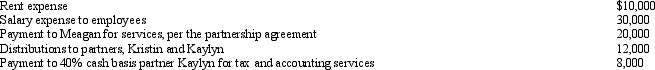

Meagan is a 40% general partner in the calendar year, cash basis MKK Partnership.The partnership received $100,000 income from services and paid the following other amounts:

How much will Meagan's adjusted gross income increase as a result of the above items?

How much will Meagan's adjusted gross income increase as a result of the above items?

Definitions:

Stoa of Attalos

A reconstructed ancient covered walkway or portico in Athens, significant in the study of Greek architecture.

Erechtheion

An ancient Greek temple on the Acropolis of Athens, known for its distinctive Porch of the Maidens (Caryatids) and historical significance in classical mythology.

Hegeso Stele

A Classical Greek grave monument displaying Hegeso, an Athenian woman, reaching for jewelry from a box, illustrating domestic life and woman's roles.

Women's Lives

Refers to the historical, social, and cultural studies focusing on the roles, experiences, and influences of women in society.

Q9: Canary Corporation has 1,000 shares of stock

Q23: JLK Partnership incurred $15,000 of organizational costs

Q24: Stacey and Andrew each own one-half of

Q30: The adjusted gross estate of Debra, decedent,

Q42: Issues relating to basis arise when a

Q47: On Form 1065, partners' capital accounts should

Q110: An example of the "entity concept" underlying

Q115: Which of the following statements is always

Q117: City, Inc., an exempt organization, has included

Q130: Your client has operated a sole proprietorship