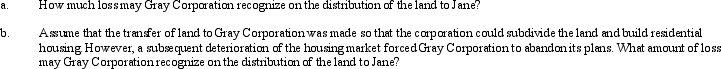

Mary and Jane, unrelated taxpayers, own Gray Corporation's stock equally.One year before the complete liquidation of Gray, Mary transfers land (basis of $420,000, fair market value of $350,000) to Gray Corporation as a contribution to capital.Assume that Mary also contributed other property in the same transaction having a basis of $20,000 and fair market value of $95,000.In liquidation, Gray distributes the land to Jane.At the time of the liquidation, the land is worth $290,000.

Definitions:

Parallel

Occurring or existing at the same time or in a similar way; corresponding.

Lower Legs

Lower Legs refer to the part of the human body extending from the knee to the ankle, encompassing the tibia, fibula, muscles, and ligaments.

Chair Position

describes a role of leadership or authority within a meeting, organization, committee, or academic department.

Elderly Patients

Refers to individuals, typically aged 65 years and older, who may require specialised medical treatment and care due to aging-related health issues.

Q3: In the current year, Amber, Inc., a

Q25: The MOG Partnership reports ordinary income of

Q38: Which of the following are organizations exempt

Q45: Penguin Corporation purchased bonds (basis of $190,000)

Q50: Woeful, Inc., a tax-exempt organization, leases a

Q51: Binita contributed property with a basis of

Q72: If a partnership allocates losses to the

Q80: Joe and Kay form Gull Corporation.Joe transfers

Q93: An S corporation can claim a deduction

Q126: Julian, Berta, and Maria own 400 shares,