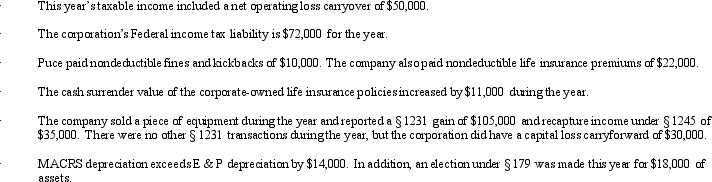

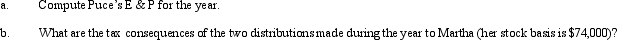

Puce Corporation, an accrual basis taxpayer, has struggled to survive since its formation, six years ago.As a result, it has a deficit in accumulated E & P at the beginning of the year of $340,000.This year, however, Puce earned a significant profit; taxable income was $240,000.Consequently, Puce made two cash distributions to Martha, its sole shareholder: $150,000 on July 1 and $200,000 December 31.The following information might be relevant to determining the tax treatment of the distributions.

Definitions:

Assertiveness

The quality of being self-assured and confident without being aggressive, effectively communicating one's needs and desires.

Personal Appeals

Requests or suggestions that are based on personal relationships or friendships rather than on formal authority or logic.

Exchange

The act of giving something to someone and receiving something else in return.

Inspirational Appeals

Techniques used to motivate others by appealing to their values, hopes, and aspirations.

Q22: An S corporation with substantial AEP has

Q23: The following citation is correct: Larry<br>G.Mitchell, 131

Q27: Section 1231 property includes nonpersonal use property

Q39: Adrian is the president and sole shareholder

Q61: In a U.S.District Court, a jury can

Q64: Five years ago, Eleanor transferred property she

Q66: Short-term capital gain is eligible for a

Q68: What effect do deductible gambling losses for

Q105: Ashley and Andrew, equal shareholders in Parrot

Q127: In a proportionate liquidating distribution, Scott receives