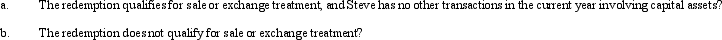

Steve has a capital loss carryover in the current year of $90,000. He owns 3,000 shares of stock in Carmine Corporation, which he purchased six years ago for $50 per share. In the current year, Carmine Corporation (E & P of $750,000) redeems all of his shares for $320,000. Steve is in the 35% tax bracket. What is his tax liability with respect to the corporate distribution if:

Definitions:

U.S. Bureau of Labor Statistics

A federal agency that collects and analyzes essential economic information related to labor market activity, working conditions, and price changes in the economy.

American Companies

refer to business enterprises based in the United States, known for their influence on the global economy and innovation in various sectors.

Overseas Companies

Businesses that operate outside their home country, engaging in international trade or services.

Discrimination

Your behavior, or what you do (or intend to do, or are inclined to do) as a result of your stereotypes and prejudice.

Q22: An S corporation with substantial AEP has

Q26: Jake, the sole shareholder of Peach Corporation,

Q46: As a general rule, the sale or

Q50: What incentives do the tax accounting rules

Q61: If the AMT base is greater than

Q73: Swan Corporation makes a property distribution to

Q77: Section 1231 property includes nonpersonal use property

Q84: What is the rationale underlying the tax

Q125: Pheasant Corporation, a calendar year taxpayer, has

Q153: Syndication costs arise when partnership interests are