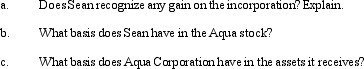

Sean, a sole proprietor, is engaged in a service business and uses the cash basis of accounting.In the current year, Sean incorporates his business by forming Aqua Corporation.In exchange for all of its stock, Aqua receives: assets (basis of $400,000 and fair market value of $2 million), trade accounts payable of $110,000, and loan due to a bank of $390,000.The proceeds from the bank loan were used by Sean to provide operating funds for the business.Aqua Corporation assumes all of the liabilities transferred to it.

Definitions:

Domestic Work

Tasks and chores performed within the home, such as cooking, cleaning, and childcare, often without pay.

Myths

Widely held but false beliefs or ideas, often rooted in tradition or folklore.

Sexual Response

A physiological reaction to sexual stimulation.

Gay Rights

The fight for equality and legal rights for individuals who identify as homosexual, encompassing issues like marriage, adoption, and discrimination.

Q12: An individual taxpayer received a valuable painting

Q18: Wade and Paul form Swan Corporation with

Q18: If a parent corporation makes a §

Q37: Warbler Corporation, an accrual method regular corporation,

Q44: Three judges will normally hear each U.S.Tax

Q57: In a proportionate liquidating distribution, RST Partnership

Q69: The Internal Revenue Code of 1986 was

Q77: Betty's adjusted gross estate is $9 million.The

Q84: What is the rationale underlying the tax

Q114: The subdivision of real property into lots