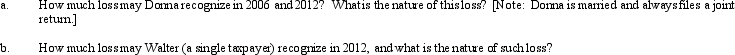

In 2005, Donna transferred assets (basis of $300,000 and fair market value of $250,000) to Egret Corporation in return for 200 shares of § 1244 stock. Due to § 351, the transfer was nontaxable; therefore, Donna's basis in the Egret stock is $300,000. In 2006, Donna sells 100 of these shares to Walter (a family friend) for $100,000. In 2012, Egret Corporation files for bankruptcy, and its stock becomes worthless.

Definitions:

Audiences

Groups of people who actively watch, read, listen to, or engage with a particular form of media or performance.

Ideological Analysis

The study of media to uncover the underlying political or social beliefs influencing the content.

Media Representations

The portrayal or depiction of specific entities, identities, or issues within various media outlets and formats.

Reality

The state of things as they actually exist, as opposed to an idealistic or notional idea of them.

Q17: Spencer has an investment in two parcels

Q38: George (an 80% shareholder) has made loans

Q63: For a corporate restructuring to qualify as

Q69: On December 31, 2012, Flamingo, Inc., a

Q78: In structuring the capitalization of a corporation,

Q83: Under what circumstances are corporations exempt from

Q114: Tim and Darby are equal partners in

Q123: Vertical, Inc., has a 2012 net §

Q124: Nicole's basis in her partnership interest was

Q126: Copper Corporation sold machinery for $27,000 on