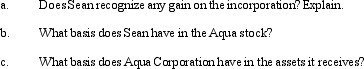

Sean, a sole proprietor, is engaged in a service business and uses the cash basis of accounting.In the current year, Sean incorporates his business by forming Aqua Corporation.In exchange for all of its stock, Aqua receives: assets (basis of $400,000 and fair market value of $2 million), trade accounts payable of $110,000, and loan due to a bank of $390,000.The proceeds from the bank loan were used by Sean to provide operating funds for the business.Aqua Corporation assumes all of the liabilities transferred to it.

Definitions:

Old Equipment

Machinery or tools that have been used for a long period and may be outdated or less efficient compared to newer versions.

Calculate

Calculate involves using mathematical or statistical methods to determine or assess a particular value, quantity, or outcome based on given data or parameters.

Opportunity Costs

The cost of forgoing the next best alternative when making a decision.

Relevant Costs

Costs that should be considered when making decisions, characterized by their occurrence in the future and variability depending on the decision made.

Q8: Barry and Irv form Rapid Corporation. Barry

Q23: All of the following statements are true

Q33: During the current year, Lavender Corporation, a

Q43: Eagle Corporation owns stock in Hawk Corporation

Q67: Andrew owns 100% of the stock of

Q77: Which of the following statements is incorrect

Q84: Generally, deductions for additions to reserves for

Q84: An individual taxpayer has the gains and

Q112: Suzy purchased vacant land in 2005 that

Q136: On January 30, Juan receives a nontaxable