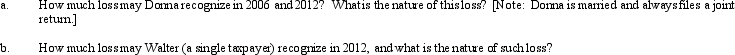

In 2005, Donna transferred assets (basis of $300,000 and fair market value of $250,000) to Egret Corporation in return for 200 shares of § 1244 stock. Due to § 351, the transfer was nontaxable; therefore, Donna's basis in the Egret stock is $300,000. In 2006, Donna sells 100 of these shares to Walter (a family friend) for $100,000. In 2012, Egret Corporation files for bankruptcy, and its stock becomes worthless.

Definitions:

Self-actualization Needs

Abraham Maslow's hierarchy's highest level, where individuals seek to realize their personal potential and achieve peak experiences.

Achievement Motive

The intrinsic drive to excel, achieve in relation to a set of standards, and strive to succeed or reach a high standard of performance.

Learned Needs Model

A theory that suggests that needs can be acquired through experiences and situation, shaping an individual's behavior and motivations.

Self-actualization Needs

The highest level in Maslow's hierarchy of needs, involving the pursuit of realizing one's own potential, self-fulfillment, and personal growth.

Q10: What are the tax consequences if an

Q15: Ivory Corporation, a calendar year, accrual method

Q39: Which of the following creates potential §

Q52: Three individuals form Skylark Corporation with the

Q55: A subsidiary is liquidated pursuant to §

Q71: Which of the following is a correct

Q71: Peggy uses a delivery van in her

Q82: Which of these is not a correct

Q89: Adam transfers cash of $300,000 and land

Q142: The dividends received deduction is added back