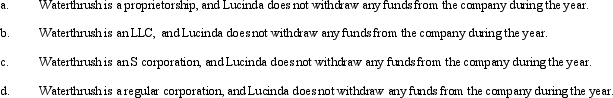

During the current year, Waterthrush Company had operating income of $510,000 and operating expenses of $400,000. In addition, Waterthrush had a long-term capital gain of $30,000. How does Lucinda, the sole owner of Waterthrush Company, report this information on her individual income tax return under following assumptions?

Definitions:

Perceptual Constancy

The psychological tendency to perceive the size, shape, color, and brightness of an object as constant even when the stimuli changes.

Perceptual Adaptation

The ability of the body to adjust to an environment by filtering out distractions, enabling more effective perception.

Feature Detection

The process by which the brain identifies specific elements of sensory input, like edges or movements, to perceive objects or scenes.

Interposition

A visual cue in perceiving depth, where one object partially blocks another, leading the observer to perceive the blocking object as closer.

Q12: For regular income tax purposes, Yolanda, who

Q14: The stock in Tangerine Corporation is held

Q16: Rachel owns 100% of the stock of

Q26: If a shareholder owns stock received as

Q32: When computing current E & P, taxable

Q47: In the current year, Plum Corporation, a

Q49: In order to retain the services of

Q56: Cocoa Corporation is acquiring Milk Corporation in

Q101: How does the payment of a property

Q123: In September, Dorothy purchases a building for