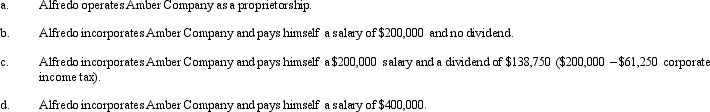

Amber Company has $400,000 in net income in 2012 before deducting any compensation or other payment to its sole owner, Alfredo. Assume that Alfredo is in the 35% marginal tax bracket. Discuss the tax aspects of each of the following independent arrangements. (Assume that any salaries are reasonable in amount and ignore any employment tax considerations.)

Definitions:

Aerial Perspective

A technique in art and photography that simulates depth by depicting distant objects as paler, less detailed, and usually bluer than nearer objects.

Kinetic Depth Effect

A visual phenomenon where the motion of an object reveals its three-dimensional structure.

Motion Parallax

A depth cue in which objects closer move faster across the visual field than objects that are further away, creating a sense of depth.

Movement Illusion

An optical illusion where a static image appears to be moving due to the cognitive effects of interacting color contrasts and shape position.

Q12: One advantage of acquiring a corporation via

Q28: Why is it generally undesirable to pass

Q37: What is the easiest way for a

Q37: Which of the following comparisons is correct?<br>A)Corporations

Q48: Mallard Corporation, a C corporation that is

Q50: Scarlet Corporation (a calendar year taxpayer) has

Q53: The stock of Tan Corporation (E &

Q63: The exercise of an incentive stock option

Q64: Judith (now 37 years old) owns a

Q178: If Wal-Mart stock increases in value during