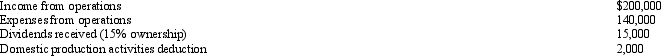

During the current year, Kingbird Corporation (a calendar year C corporation) had the following income and expenses:  On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items) . Determine Kingbird's charitable contribution deduction for the current year.

On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items) . Determine Kingbird's charitable contribution deduction for the current year.

Definitions:

Stock Options

Financial tools that provide the holder with the option, but not the commitment, to purchase or sell shares at a set price during a defined period.

Short-term Earnings

Profits or income that a company generates over a short period of time, often reported quarterly or annually.

Wall Street

The financial district of New York City, famous for being the headquarters of major brokerages and investment banks.

Compensation Discussion

An analysis or discussion centered around the policies and decisions related to executive compensation within an organization.

Q22: Jackson sells qualifying small business stock for

Q28: Why is it generally undesirable to pass

Q35: Discuss the tax year in which an

Q41: Puce Corporation, an accrual basis taxpayer, has

Q74: Ed and Cheryl have been married for

Q75: After 5 years of marriage, Dave and

Q85: Emma gives her personal use automobile (cost

Q85: The fair market value of property received

Q119: For individual taxpayers, the AMT credit is

Q130: Your client has operated a sole proprietorship