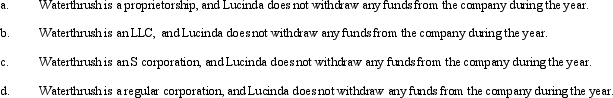

During the current year, Waterthrush Company had operating income of $510,000 and operating expenses of $400,000. In addition, Waterthrush had a long-term capital gain of $30,000. How does Lucinda, the sole owner of Waterthrush Company, report this information on her individual income tax return under following assumptions?

Definitions:

Planning Fallacy

The tendency to underestimate the time, costs, and risks of future actions while overestimating the benefits, leading to poor planning and outcomes.

"All-Nighters"

Extended work or study sessions that last throughout the night, often used to meet deadlines or prepare for exams.

Term Paper

An academic assignment or research paper that is usually due at the end of a term or semester.

Prospect Theory

An economic theory that describes how people choose between probabilistic alternatives that involve risk, where the probabilities of outcomes are uncertain.

Q8: Red Corporation and Green Corporation are equal

Q8: What will cause the corporations involved in

Q14: Which of the following statements is incorrect?<br>A)If

Q15: Boyd acquired tax-exempt bonds for $430,000 in

Q17: During the current year, Thrasher, Inc., a

Q17: For a taxpayer who is required to

Q22: Luis is the sole shareholder of a

Q36: The determination of whether a shareholder's gain

Q50: Copper Corporation, a C corporation, had gross

Q98: Federal income tax paid in the current