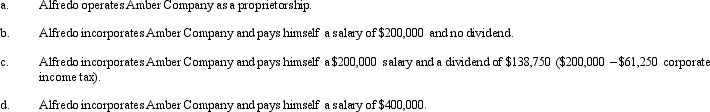

Amber Company has $400,000 in net income in 2012 before deducting any compensation or other payment to its sole owner, Alfredo. Assume that Alfredo is in the 35% marginal tax bracket. Discuss the tax aspects of each of the following independent arrangements. (Assume that any salaries are reasonable in amount and ignore any employment tax considerations.)

Definitions:

Addiction

A persistent, recurring condition defined by an irresistible urge to seek drugs, persistent consumption despite adverse effects, and enduring alterations in brain function.

Dentists

Healthcare professionals specializing in the diagnosis, prevention, and treatment of diseases and conditions of the oral cavity.

Blocking

A learning process where the presence of an established conditioned stimulus interferes with the learning of a new conditioned stimulus.

Salience

The quality of being particularly noticeable or important; the state or condition by which something stands out from its surroundings or background in perception.

Q1: Discuss the relationship between the postponement of

Q15: A distribution from a corporation will be

Q41: To ease a liquidity problem, all of

Q55: Federal tax legislation generally originates in what

Q70: A corporation that distributes a property dividend

Q71: When a patent is transferred, the most

Q76: Gold Corporation, Silver Corporation, and Platinum Corporation

Q93: If a transaction qualifies under § 351,

Q118: AGI is used as the base for

Q128: Explain the stock attribution rules that apply