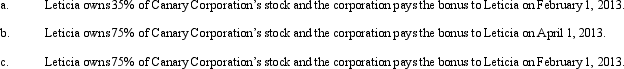

Canary Corporation, an accrual method C corporation, uses the calendar year for tax purposes. Leticia, a cash method taxpayer, is both a shareholder of Canary and the corporation's CFO. On December 31, 2012, Canary has accrued a $75,000 bonus to Leticia. Describe the tax consequences of the bonus to Canary and to Leticia under the following independent situations.

Definitions:

Demand

The quantity of a good or service consumers are willing and able to purchase at various prices during a specified time period.

Cross-Price Elasticity

A measure of how much the quantity demanded of one good responds to a change in the price of another good.

Hot Dogs And Mustard

A classic food pairing where the mustard serves as a condiment for the hot dogs, enhancing flavor.

Price-Inelastic

A description of a good or service whose demanded quantity does not significantly change when its price changes, indicating low sensitivity to price.

Q3: A retailer must actually receive a claim

Q8: Federal tax legislation generally originates in the

Q28: Pursuant to a liquidation, Coral Corporation distributes

Q37: The Golsen rule has been overturned by

Q44: On December 20, 2012, the directors of

Q47: White Company acquires a new machine for

Q58: In regard to choosing a tax year

Q74: Hal sold land held as an investment

Q90: What is the relationship between taxable income

Q118: At a time when Blackbird Corporation had