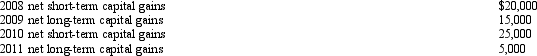

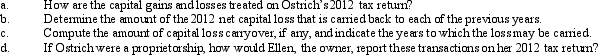

Ostrich, a C corporation, has a net short-term capital gain of $20,000 and a net long-term capital loss of $90,000 during 2012.Ostrich also has taxable income from other sources of $1 million.Prior years' transactions included the following:

Definitions:

Environmental Factors

External elements, including physical, chemical, and biological factors, that can influence living organisms or human health.

Enduring Marriage

A long-lasting marital relationship characterized by mutual respect, affection, and a strong bond between partners.

Conduct Problems

Behavioral and emotional issues in children and adolescents, characterized by actions that violate societal norms or the rights of others.

Introvert

a person with a personality trait or type characterized by a focus on internal feelings rather than external sources of stimulation.

Q3: The research process should begin with a

Q9: A realized gain on the sale or

Q12: For regular income tax purposes, Yolanda, who

Q22: A Revenue Ruling is a judicial source

Q30: A shareholder bought 2,000 shares of Zee

Q40: The net capital gain included in an

Q58: In regard to choosing a tax year

Q73: Swan Corporation makes a property distribution to

Q104: Elk, a C corporation, has $370,000 operating

Q127: Kite Corporation has 1,000 shares of stock