Multiple Choice

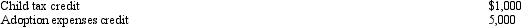

Prior to the effect of the tax credits, Justin's regular income tax liability is $200,000 and his tentative AMT is $195,000.Justin has the following credits:  Calculate Justin's tax liability after credits.

Calculate Justin's tax liability after credits.

Definitions:

Related Questions

Q40: In the current year, Carnation Corporation has

Q46: As a general rule, the sale or

Q58: Kaya is in the 33% marginal tax

Q65: In a nontaxable exchange, recognition is postponed.In

Q71: A calendar year C corporation with average

Q86: A C corporation's selection of a tax

Q97: To carry out a qualifying stock redemption,

Q131: How does the definition of accumulated E

Q137: A business taxpayer sells depreciable business property

Q172: Pierce exchanges an asset (adjusted basis of