Multiple Choice

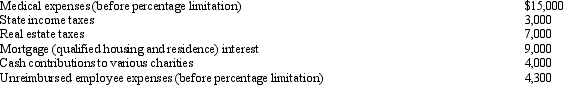

Mitch, who is single and has no dependents, had AGI of $100,000 in 2012.His potential itemized deductions were as follows:  What is the amount of Mitch's AMT adjustment for itemized deductions for 2012?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2012?

Definitions:

Related Questions

Q10: Orange Corporation owns stock in White Corporation

Q20: At the time of her death, Janice

Q27: As of January 1, Cassowary Corporation has

Q61: What is a deathbed gift and what

Q70: Iva owns Mauve, Inc.stock (adjusted basis of

Q84: Sammy exchanges equipment used in his business

Q95: Willie is the owner of vacant land

Q104: Elk, a C corporation, has $370,000 operating

Q120: Rental use depreciable machinery held more than

Q143: The rules used to determine the taxability