Multiple Choice

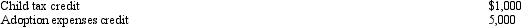

Prior to the effect of the tax credits, Justin's regular income tax liability is $200,000 and his tentative AMT is $195,000.Justin has the following credits:  Calculate Justin's tax liability after credits.

Calculate Justin's tax liability after credits.

Definitions:

Related Questions

Q10: Orange Corporation owns stock in White Corporation

Q12: For regular income tax purposes, Yolanda, who

Q22: Misty owns stock in Violet, Inc., for

Q27: Carmen and Carlos form White Corporation. Carmen

Q53: Which of the following is (are) a

Q64: Joyce's office building was destroyed in a

Q66: Albert is in the 35% marginal tax

Q94: What characteristics must the seller of a

Q130: Which of the following is correct concerning

Q184: A taxpayer whose principal residence is destroyed