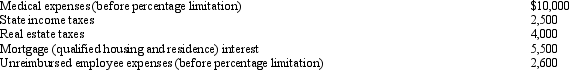

Cindy, who is single and has no dependents, has adjusted gross income of $50,000 in 2012.Her potential itemized deductions are as follows:

What is the amount of Cindy's AMT adjustment for itemized deductions for 2012?

What is the amount of Cindy's AMT adjustment for itemized deductions for 2012?

Definitions:

Recognition

The ability to identify previously encountered objects, ideas, or situations, often used as a measure of memory in cognitive psychology.

Priming

A psychological phenomenon where exposure to a stimulus influences a response to a subsequent stimulus, without conscious guidance or intention.

Recall

The cognitive process of retrieving information from memory, which can be influenced by various factors such as the method of encoding, the context of recollection, and the passage of time.

Processing Speed

The pace at which an individual can take in information, understand it, and begin to respond. This can involve sensory processing, thinking, and motor responses.

Q8: Barry and Irv form Rapid Corporation. Barry

Q49: Is it possible that no AMT adjustment

Q61: In order to induce Yellow Corporation to

Q67: Andrew owns 100% of the stock of

Q74: Prior to the effect of tax credits,

Q84: Juanita owns 60% of the stock in

Q108: Ashlyn is subject to the AMT in

Q116: Tom has owned 40 shares of Orange

Q132: Purchased goodwill is assigned a basis equal

Q172: Pierce exchanges an asset (adjusted basis of