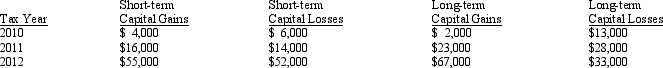

The chart below details Sheen's 2010, 2011, and 2012 stock transactions.What is the capital loss carryover to 2012 and what is the net capital gain or loss for 2012?

Definitions:

Gain on Sale

The profit recognized when an asset is sold for more than its carrying amount.

Other Revenue

Income that a business earns from activities not related to its primary operations, such as investment income or rental income.

Fixed Assets

Long-term tangible assets that are used in the operations of a business and are not expected to be consumed or converted into cash in the short term, such as property, plant, and equipment.

Current Assets

Items expected to be cashed in, liquidated, or expended within 12 months or throughout the duration of the business cycle, whichever period is greater.

Q15: Mitchell and Powell form Green Corporation. Mitchell

Q34: Azure Corporation, a C corporation, had a

Q48: If there is an involuntary conversion (i.e.,

Q58: Kaya is in the 33% marginal tax

Q60: All of a taxpayer's tax credits relating

Q69: Any unused general business credit must be

Q86: Some (or all) of the tax credit

Q89: Section 1245 depreciation recapture potential does not

Q101: Noelle received dining room furniture as a

Q154: An exchange of business or investment property