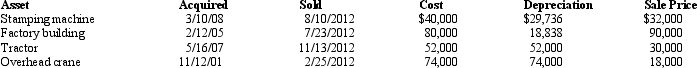

The chart below describes the § 1231 assets sold by the Ecru Company (a sole proprietorship) this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year.Assume there is a § 1231 lookback loss of $4,000.

Definitions:

Oral Hygiene Care

The practice of keeping the mouth, teeth, and gums clean and healthy to prevent disease, including regular brushing and flossing.

Padded Tongue Blade

A medical device with padding used to protect the patient's tongue and teeth during procedures or to assist in keeping the airway open.

Hydrogen Peroxide

A chemical compound (H2O2) used as an antiseptic, disinfectant, and bleach.

Bag Bath

A method of bathing that uses premoistened, disposable cloths to clean the body, often used in healthcare settings for patients who are bedridden.

Q8: Which of the following statements is correct?<br>A)In

Q21: Gains and losses on nontaxable exchanges are

Q30: A condemned office building owned and used

Q37: Vanessa's personal residence was condemned, and she

Q47: Karen purchased 100 shares of Gold Corporation

Q79: To be eligible to elect postponement of

Q100: Explain the purpose of the disabled access

Q112: Evan is a contractor who constructs both

Q124: Robert and Diane, husband and wife, live

Q142: In 2012, Mark has $18,000 short-term capital