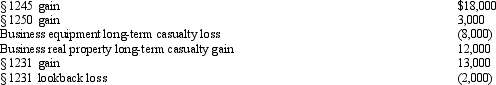

Betty, a single taxpayer with no dependents, has the gains and losses shown below. Before considering these transactions, Betty has $45,000 of other taxable income. What is the treatment of the gains and losses and what is Betty's taxable income?

Definitions:

Profit Margin

The ratio of net income earned to total revenue received by a business, indicating the efficiency of converting sales into profit.

Investment Turnover

A ratio measuring the efficiency of a company's use of its assets in generating sales revenue; calculated as sales divided by invested assets.

Transfer Price

The price at which goods and services are sold between divisions or branches within the same company.

Variable Cost

Variable Cost refers to expenses that change in proportion to the business activity level or volume of production.

Q10: If the taxpayer elects to capitalize intangible

Q24: In 2008, Harold purchased a classic car

Q37: Which of the following statements is true

Q40: The due date (not including extensions) for

Q41: During the current year, Violet, Inc., a

Q45: During 2012, Sparrow Corporation, a calendar year

Q91: Which of the following statements is correct?<br>A)A

Q92: Tony is married and files a joint

Q118: AGI is used as the base for

Q133: Carol had the following transactions during 2012: