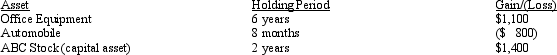

The following assets in Jack's business were sold in 2012:  The office equipment had a zero adjusted basis and was purchased for $8,000.The automobile was purchased for $2,000 and sold for $1,200.The ABC stock was purchased for $1,800 and sold for $3,200.In 2012 (the year of sale) , Jack should report what amount of net capital gain and net ordinary income?

The office equipment had a zero adjusted basis and was purchased for $8,000.The automobile was purchased for $2,000 and sold for $1,200.The ABC stock was purchased for $1,800 and sold for $3,200.In 2012 (the year of sale) , Jack should report what amount of net capital gain and net ordinary income?

Definitions:

Blood Pressure

The force of circulating blood on the walls of blood vessels, often measured as an indicator of cardiovascular health.

Cellular Immunity

One of the three general categories of immune response, based on the action of a class of blood cells called T-lymphocytes. The “T” designation refers to the locus of their production, the thymus gland. Cellular immunity results from a cascade of actions of various types of T-lymphocytes.

Monocytes

A type of white blood cell that plays a critical role in the immune system by killing pathogens, removing dead cells, and stimulating the action of other immune cells.

Q50: For each of the following involuntary conversions,

Q62: Nancy is a 40% shareholder and president

Q65: Kerri, who had AGI of $120,000, itemized

Q66: Which of the following statements is correct

Q74: Almond Corporation, a calendar year C corporation,

Q95: Willie is the owner of vacant land

Q105: Several years ago, Tom purchased a structure

Q118: A worthless security had a holding period

Q131: Ben sells stock (adjusted basis of $25,000)

Q158: Gift property (disregarding any adjustment for gift