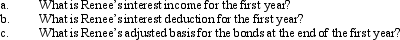

Renee purchases taxable bonds with a face value of $200,000 for $212,000.The annual interest paid on the bonds is $10,000.Assume Renee elects to amortize the bond premium.The total premium amortization for the first year is $1,600.

Definitions:

Central Location

A statistical term referring to the center or typical value of a distribution, often measured by the mean, median, or mode.

Ordinal

Relating to an order or sequence; typically referring to data that can be ranked but the intervals between values are not uniform.

Negatively Skewed

Describes a distribution of data where the tail on the left side of the distribution is longer or fatter, indicating that the bulk of the values are concentrated on the right.

Proportion

A statistical measure indicating the fraction of a whole that is made up by a certain characteristic or subset.

Q1: If circulation expenditures are amortized over a

Q20: Steve purchased his home for $500,000.As a

Q21: Which of the following assets held by

Q22: Jackson sells qualifying small business stock for

Q29: Vicki owns and operates a news agency

Q65: In a nontaxable exchange, recognition is postponed.In

Q70: Rick, a computer consultant, owns a separate

Q99: Compare the taxation of C corporations with

Q131: Ben sells stock (adjusted basis of $25,000)

Q164: If the buyer assumes the seller's liability