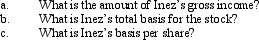

Inez's adjusted basis for 9,000 shares of Cardinal, Inc.common stock is $900,000.During the year, she receives a 5% stock dividend that is a nontaxable stock dividend.

Definitions:

Relevant Evidence

Information or data that has a bearing on the truth or falsity of any fact at issue in a legal proceeding.

Emotional Basis

The underlying emotional reasons or motivations for an individual's thoughts, actions, or responses.

Federal Rules

Regulations established by the federal government that govern legal procedures and administrative operations.

Patriot Act

A legislative act passed in 2001 aimed at enhancing domestic security through expanding law enforcement's ability to monitor, detect, and prosecute potential terrorist activities.

Q1: Tomas owns a sole proprietorship, and Lucy

Q17: Tariq sold certain U.S.Government bonds and State

Q22: Jackson sells qualifying small business stock for

Q41: Orange Corporation, a closely held (non-personal service)

Q45: The Yellow Equipment Company, an accrual basis

Q49: Is it possible that no AMT adjustment

Q69: On December 31, 2012, Flamingo, Inc., a

Q83: Under what circumstances are corporations exempt from

Q102: Phil and Audrey, husband and wife, are

Q131: Ben sells stock (adjusted basis of $25,000)