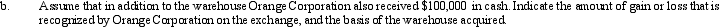

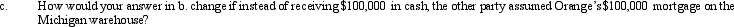

a. Orange Corporation exchanges a warehouse located in Michigan (adjusted basis of $560,000) for a warehouse located in Ohio (adjusted basis of $450,000; fair market value of $525,000).Indicate the amount of gain or loss that is recognized by Orange Corporation on the exchange, and the basis of the warehouse acquired.

Definitions:

Carried Forward

The act of transferring a balance from one period to the next on financial statements or ledgers.

Owners' Equity

The total value belonging to the owners of a company, calculated as the company's total assets minus its total liabilities, indicative of the net worth.

Net Worth

The total value of an individual's or organization's assets minus liabilities, representing the financial health or value of the entity.

Dividends

Payments made by a corporation to its shareholder members, distributing a portion of the company's earnings.

Q16: Unless a taxpayer is disabled, the tax

Q21: In 2012, Emily invests $100,000 in a

Q27: Last year, Ted invested $100,000 for a

Q29: Vicki owns and operates a news agency

Q35: Charles owns a business with two separate

Q37: Vanessa's personal residence was condemned, and she

Q77: The earned income credit, a form of

Q78: Lois received nontaxable stock rights with a

Q83: For a corporate distribution of cash or

Q186: The holding period of nontaxable stock rights