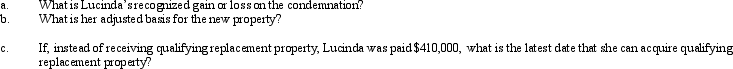

Lucinda, a calendar year taxpayer, owned a rental property with an adjusted basis of $312,000 in a major coastal city.Her property was condemned by the city government on October 12, 2012.In order to build a convention center, Lucinda eventually received qualified replacement property from the city government on March 9, 2013.This new property has a fair market value of $410,000.

Definitions:

Accounts Receivable

Money owed to a company by its customers for goods or services that have been delivered but not yet paid for.

Asset Utilization Ratios

Ratios that measure how well a firm uses its assets to generate each $1 of sales.

Short-Term Assets

Assets that are expected to be converted into cash or used up within one year or within the business's operating cycle if longer than a year.

Q5: Gabe's office building (adjusted basis of $430,000;

Q6: Maud exchanges a rental house at the

Q27: For disallowed losses on related-party transactions, who

Q50: For each of the following involuntary conversions,

Q63: Robert sold his ranch which was his

Q78: Martha is single with one dependent and

Q88: In May 2012, Blue Corporation hired Camilla,

Q90: Francisco is the sole owner of Rose

Q144: Individuals who are not professional real estate

Q149: Karla owns 200 acres of farm land