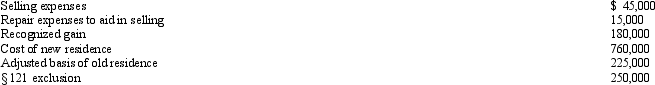

Use the following data to determine the sales price of Etta's principal residence and the realized gain.She is not married.The sale of the old residence qualifies for the § 121 exclusion.

Definitions:

Vacuum Enclosure

A container from which air and other gases are removed to create a vacuum, often used in scientific research and industrial processes.

Brake Dust

The accumulation of particulate matter produced from the friction material of brake pads rubbing against the brake disc when the brakes are applied, often seen on the wheels of cars.

Hydraulic System

A system that uses fluid under pressure to power machinery or move mechanical components.

Brake Pedal

A mechanism that activates the brake system in a vehicle, allowing the driver to slow down or stop the vehicle by pressing down with their foot.

Q20: The purpose of the tax credit for

Q41: In 2012, Ben exercised an incentive stock

Q64: Judith (now 37 years old) owns a

Q68: The accrual method generally is required to

Q73: Wyatt sells his principal residence in December

Q81: Marvin, the vice president of Lavender, Inc.,

Q82: Beige Corporation, a C corporation, purchases a

Q83: Under what circumstances are corporations exempt from

Q100: Explain the purpose of the disabled access

Q132: Purchased goodwill is assigned a basis equal