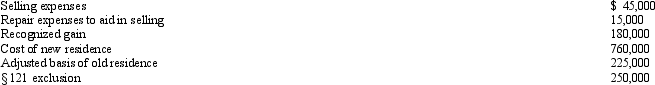

Use the following data to determine the sales price of Etta's principal residence and the realized gain.She is not married.The sale of the old residence qualifies for the § 121 exclusion.

Definitions:

Deindividuation

A psychological state where an individual loses self-awareness and self-restraint, often occurring in group settings that foster anonymity.

Social Facilitation

When the mere presence of others improves performance.

Group Polarization

The phenomenon by which a group's prevailing attitudes or beliefs become more extreme following group discussions, as members tend to support more extreme positions.

Groupthink

A psychological phenomenon that occurs within a group of people in which the desire for harmony or conformity results in an irrational or dysfunctional decision-making outcome.

Q4: Judy incurred $58,500 of interest expense this

Q16: Realized losses from the sale or exchange

Q25: Camelia Company is a large commercial real

Q43: Coyote Corporation has active income of $45,000

Q49: Chris receives a gift of a passive

Q68: Over the past 20 years, Alfred has

Q72: Harry earned investment income of $18,500, incurred

Q78: Phyllis, a calendar year cash basis taxpayer

Q84: Generally, deductions for additions to reserves for

Q118: A worthless security had a holding period