Essay

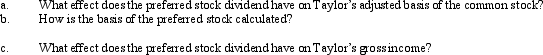

Taylor owns common stock in Taupe, Inc., with an adjusted basis of $100,000.She receives a preferred stock dividend which is nontaxable.

Definitions:

Related Questions

Q28: Julia's tentative AMT is $94,000. Her regular

Q43: In the case of a sale reported

Q48: The § 1245 depreciation recapture potential does

Q54: Faith inherits an undivided interest in a

Q60: All of a taxpayer's tax credits relating

Q71: Frederick sells land and building whose adjusted

Q74: Hal sold land held as an investment

Q78: The adjusted basis of property that is

Q88: In May 2012, Blue Corporation hired Camilla,

Q107: Which of the following exchanges qualifies for